FAFSA 2024 Changes

The FAFSA is Changing – FAFSA Simplification

Frequently Asked Questions

- Should I still complete the FAFSA?

It is highly recommended that you fill out the FAFSA form as early as possible. If you have not yet completed the FAFSA, there is plenty of time. While this year there have been several challenges and delays with the FAFSA process, the benefits of these changes are significant. The FAFSA application is now much shorter, and can be completed in less time, and updated eligibility requirements greatly expands Pell eligibility.

- My FAFSA says it needs corrections. How do I correct my FAFSA?

The Department of Education indicated that required or voluntary corrections to 2024-2025 FAFSA forms in a “Processed” status will be available in the first half of April. In the meantime, check your FAFSA Submission Summary to review your responses and understand any required actions to complete your form. Once available, please log into Studentaid.gov to resolve the errors on your FAFSA. If you are unsure of how to correct your FAFSA information, please review the Department of Education resources page on How to Correct or Update Your FAFSA form.

- My FAFSA contained errors and needs to be reprocessed, when will I receive my financial aid information?

The Department of Education has indicated that they will begin reprocessing FAFSA files impacted by data errors in the first half of April. Once Maryville receives the updated FAFSA file, we will process your financial aid offer in 3-5 days. If additional information is needed to complete your financial aid offer, you will receive additional communication from Financial Aid.

What’s changing with the FAFSA?

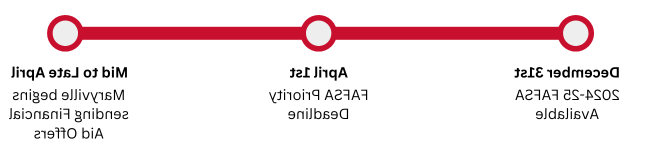

- The 2024-2025 FAFSA is now available.

You may Start your 2024-2025 FAFSA. Schools will begin receiving FAFSA data around the mid-March.

After completing the FAFSA, you will be notified the FAFSA has submitted. However, your file will not be sent to Maryville University until FAFSA files are sent to schools in March.

- The FAFSA will be shorter and more user-friendly.

The FAFSA will reduce the maximum number of questions from 108 to 46. Based on information provided, not all students will be required to answer all 46 questions. The streamlined format will simplify the application process for students and their families.

- The Estimated Family Contribution (EFC) has been replaced by the Student Aid Index (SAI).

The SAI is a different way to determine eligibility. Student Aid Index more accurately describes the number used to determine aid eligibility. Unlike the EFC, the SAI may be a negative number down to -1500.

- Spouses or Stepparents may need to participate in completing the FAFSA as a Contributor.

Who is a Contributor?Contributor is a new term being introduced on the 2024-2025 FAFSA and refers to anyone who is required to provide federal tax information directly to a student’s FAFSA form (such as a parent/stepparent or spouse), as well as a signature on the FAFSA Form. A student’s or parent’s answers on the FAFSA will determine which contributors (if any) will be required to provide information. Contributors may include the student, biological or adoptive parent, stepparent, or student’s spouse.

Contributors will receive an email informing them they’ve been identified as such and will need to log in using their own studentaid.gov account (FSA ID). If they don’t already have one, information will be provided on how to create an FSA ID.

Being identified as a contributor does not mean the contributor is financially responsible for education costs, but it does mean the contributor must provide information on the FAFSA or the application will be considered incomplete and the student will not be eligible for federal student aid.

A student’s or parent’s spouse information will still be required on the FAFSA form, even if your parent’s spouse is not identified as a contributor.

Contributors that don’t have a social security number can still create a studentaid.gov account to fill out their sections on the FAFSA form. However, you must be a U.S. citizen or eligible noncitizen to be eligible for federal student aid.

- FAFSA Applicants will be required to use the IRS Direct Data Exchange.

This information will be used to determine your eligibility for federal student aid. For this transfer to happen, you and your contributors must provide consent and approval on the FAFSA form. Previously, users had the option to enter their tax information manually or use the IRS Data Retrieval Tool. Beginning with the 2024-2025 FAFSA, all persons on the FAFSA must provide consent for the Department of Education to receive tax information or confirmation of non-filing status directly from the IRS. In a small number of cases, students and families may be required to enter their tax data manually. But for most, the data will be automatically transferred into the application. This change makes it easier to complete the FAFSA and reduces the number of questions required.

- The number in college will not be used to calculate SAI.

Previously, the FAFSA calculated the number of household members attending college in the EFC, dividing it proportionately to determine federal aid eligibility. Beginning with the 2024-2025 FAFSA, the application will still ask how many household members are in college, but your answer will not be calculated into the SAI. As such, students with siblings in college may see a change in their federal aid eligibility.

- Family farms and small businesses must be reported as assets.

When required, families must now report the value of their small business or family farm. If the family farm includes the principal place of residence, applicants should determine the total net value of all farm assets and subtract the net value of their principal residence to determine the final value of their farm assets.

FAQS

- What if a student’s parents are divorced? Who is the Contributor to their FAFSA?

The parent included on the FAFSA as a contributor must be the parent that provides the greater portion of the student’s financial support, even if it is not the parent with whom the student primarily resides. If that primary parent is remarried, the income of the parent’s spouse (stepparent) will also be required.

- Will I be eligible for federal grants under the new FAFSA?

Some undergraduate students will be automatically awarded a Pell Grant. Families making less than 175% and single parents making less than 225% of the federal poverty level will see their students receive a maximum Federal Pell Grant award. Minimum Pell grants will be guaranteed to undergraduate students from households below the 275%, 325%, 350% or 400% of the poverty level, depending on household structure. Pell awards between the maximum and minimum amounts will be determined by the Student Aid Index (SAI).

- Will an incomplete FAFSA be deleted?

An incomplete FAFSA will be deleted after 45 days of inactivity. A FAFSA cannot be considered submitted until all required contributors have completed, signed, and submitted their respective sections.

- What hasn’t changed with the FAFSA?

While many things have changed with the 2024-2025 FAFSA, several aid related matters will not change.

- The general types of aid available to students and federal student loan limits will not change.

- The FAFSA will still be required each year for consideration of federal and state financial aid.

- Dependency status questions that determine if your parent(s) must complete the FAFSA will remain the same.

- The FAFSA will still request tax information from the prior-prior tax year, which means you will report 2022 income and assets on your 2024-2025 FAFSA applications.

If you believe your FAFSA does not reflect your current circumstances, you may request a review by emailing ssc@a220149.com and requesting a Special Circumstances review to determine if any adjustments can be made to your financial aid eligibility. Supporting documentation may be required for the Special Circumstances review.

Helpful Videos

-

What Is FAFSA®?

-

What’s Changed for the 2024–25 FAFSA® Form?

-

Who Is a Contributor on the FAFSA® Form?

-

Why Do My Contributors and I Need Our Own StudentAid.gov Accounts for the FAFSA® Form?

-

How Do I Complete the 2024–25 FAFSA® Form If My Parents Are Divorced or Separated?

-

How Do I Create a StudentAid.gov Account If I Don’t Have a Social Security Number?

-

How Do I Complete the FAFSA® Form If My Parent Is a Noncitizen?

-

Who Is a Contributor on the FAFSA® Form?

-

Why Do My Contributors and I Need Our Own StudentAid.gov Accounts for the FAFSA® Form?

-

Deleted video

-

What Does It Mean To Provide Consent and Approval on the FAFSA® Form?